The Main Reason Mortgage Rates Are So High

“Mortgage-backed securities (MBS) are investment products similar to bonds. Each MBS consists of a bundle of home loans and other real estate debt bought from the banks that issued them . . . The investor who buys a mortgage-backed security is essentially lending money to home buyers.”

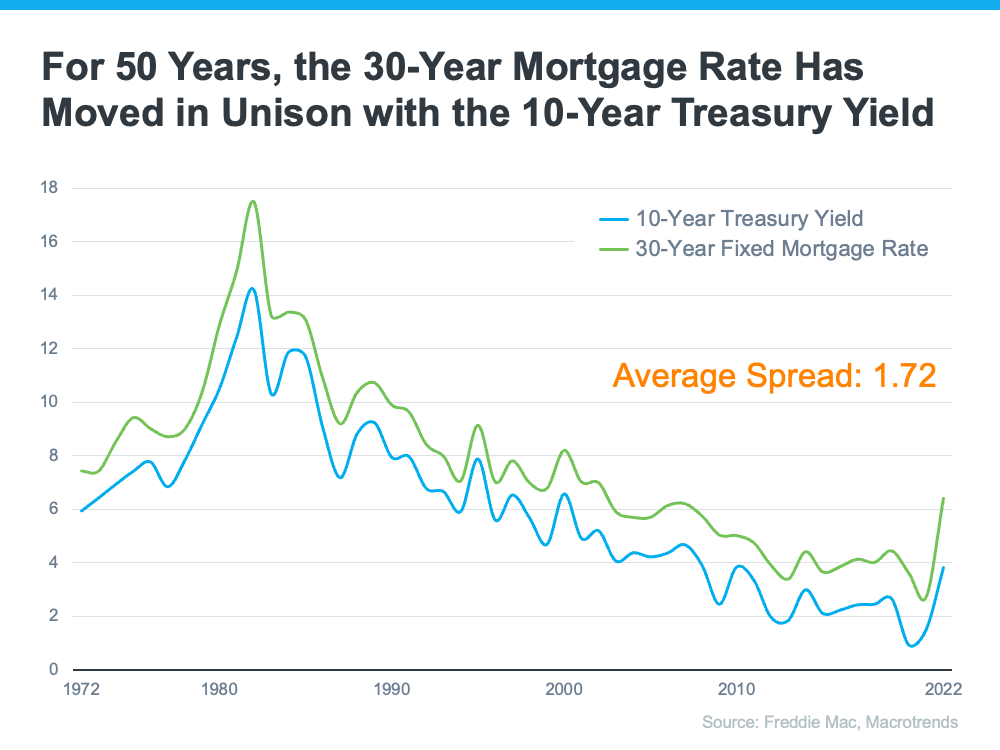

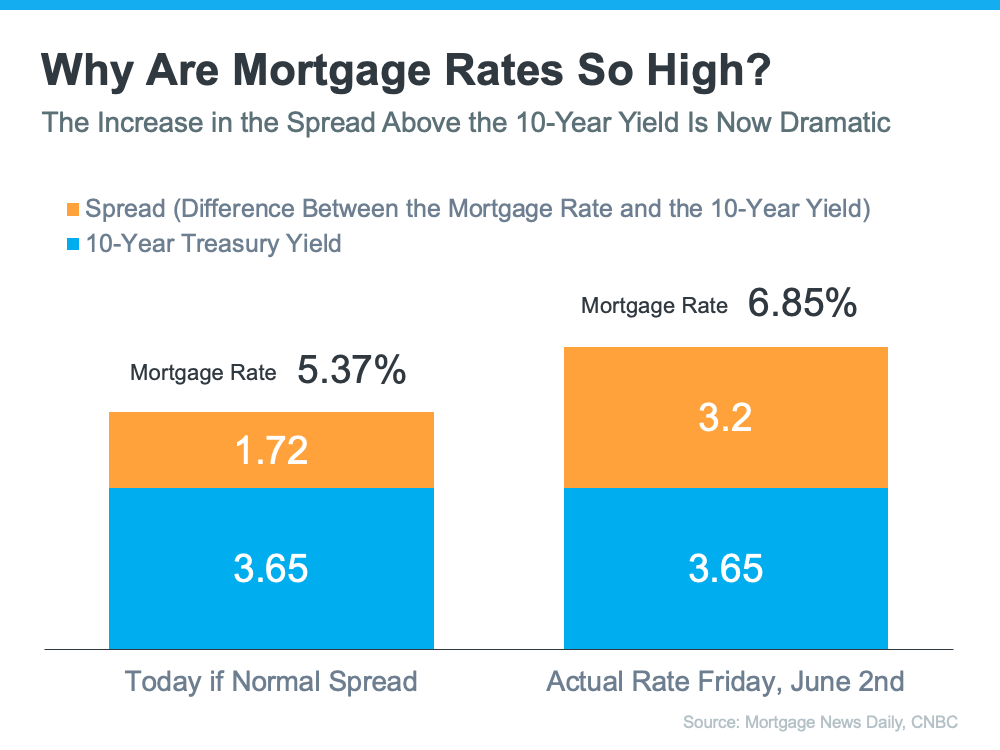

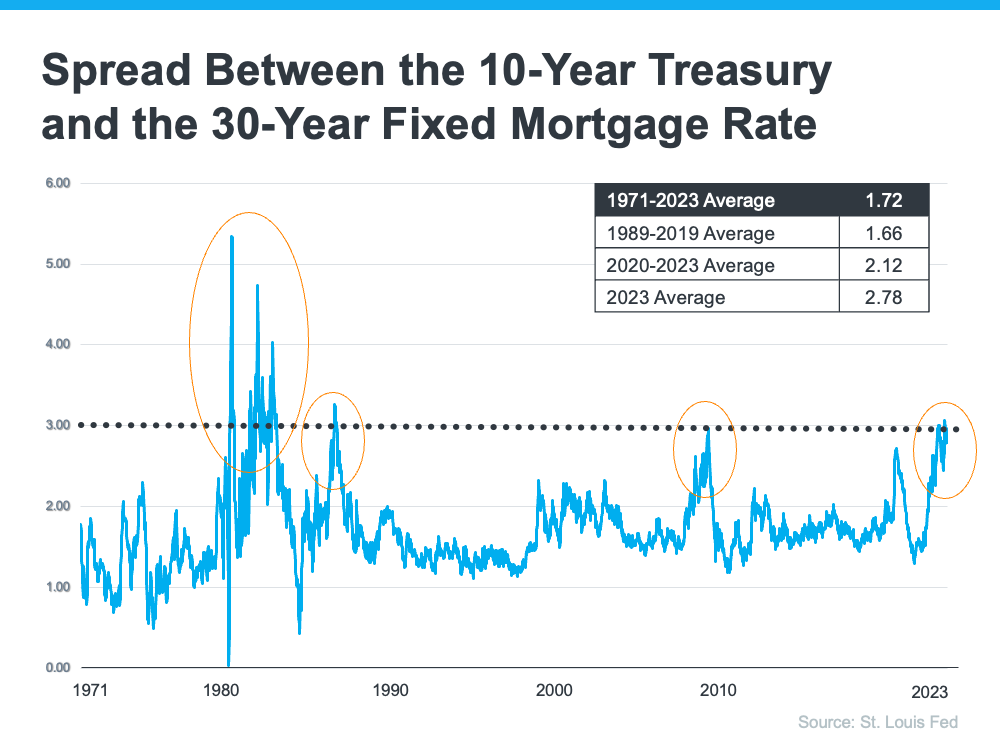

“The only times the spread approached or exceeded 300 basis points were during periods of high inflation or economic volatility, like those seen in the early 1980s or the Great Financial Crisis of 2008-09."The graph below uses historical data to help illustrate this point by showing the few times the spread has increased to 300 basis points or more:

“It’s reasonable to assume that the spread and, therefore, mortgage rates will retreat in the second half of the year if the Fed takes its foot off the monetary tightening pedal and provides investors with more certainty. However, it’s unlikely that the spread will return to its historical average of 170 basis points, as some risks are here to stay.”

By Nelida Mora, Best of Placentia 2024 & 2025 Real Estate Winner, and Placentia Rotary Club Member

Inheriting a Home in Placentia, Yorba Linda, Brea, or Fullerton: A Blessing with Hidden Burdens?

copy cat recipes

Bring a taste of Disney magic to your kitchen with this simple, three-ingredient recipe.

Real Estate, Client Stories, Home Selling

A heartfelt look at a recent home sale that went beyond the transaction, celebrating a new chapter for a cherished family.

city festival

Rotary Club of Placentia's Annual Community Fundraising Event

Are you an Orange County real estate investor searching for your next high-potential project? Look no further!

Providing clients with ultimate bespoke representation, customized marketing strategy, and a culture built on service. Excelling in exceeding expectations for buyers and sellers.